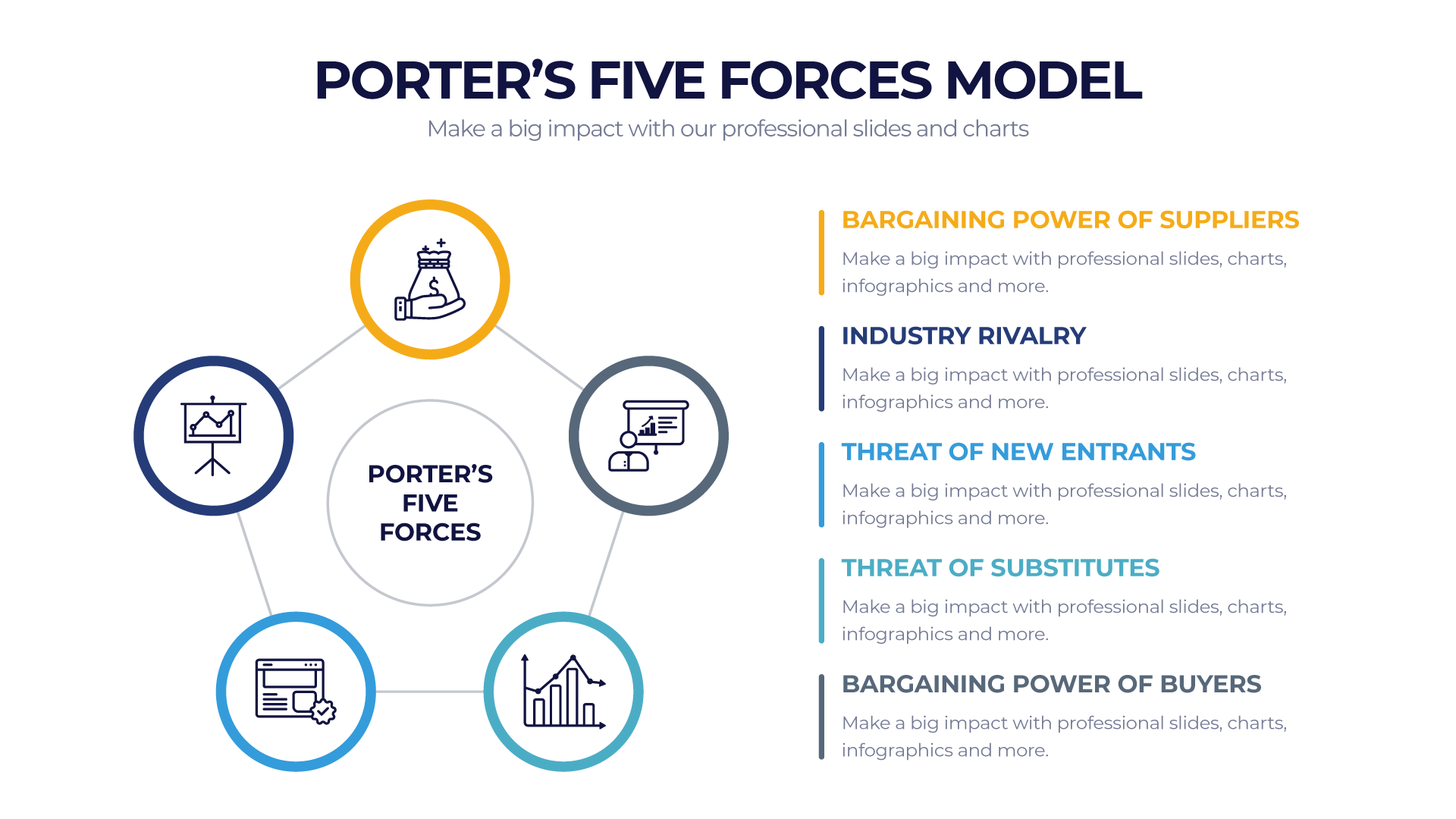

Arm yourself with the power of understanding and strategic planning as we journey through the often tumultuous terrain of 21st-century business, guided by the beacon that is Porter's Five Forces

In a world marked by rapid technological advancements and globalised competition, businesses must adapt to stay relevant. One enduring tool that offers invaluable insights into strategic planning is Michael E. Porter’s Five Forces framework.

Understanding Porter’s Five Forces

Porter’s Five Forces is a model used to analyse an industry’s competitive landscape. The five forces include:

- Competitive Rivalry: The intensity of competition among existing players in the market.

- Threat of New Entrants: The potential for new competitors to enter the market.

- Bargaining Power of Suppliers: The influence suppliers have on a company's prices and terms.

- Bargaining Power of Buyers: The power customers have to drive down prices or demand better quality.

- Threat of Substitution: The potential for customers to switch to a substitute product or service.

Relevance of Porter’s Five Forces Today

Despite being over four decades old, Porter’s framework remains crucial in today’s business environment. Its timeless relevance can be attributed to its ability to comprehensively encapsulate the complexities of market competition into five distinct, easily understandable forces. In an era where trends evolve rapidly and market dynamics shift unpredictably, Porter’s Five Forces provide a stable foundation for strategic decision-making.

With the rise of e-commerce and digital marketplaces, understanding factors like the threat of new entrants and the power of buyers have become more critical than ever. Similarly, in an age where innovation reigns supreme, the threat of substitution is a constant challenge that businesses must consider in their strategies.

Furthermore, Porter’s Five Forces model can be applied to a wide range of industries, from tech startups to traditional manufacturing sectors. It provides a lens through which businesses can evaluate their position within the industry and identify areas of strength and vulnerability. Consequently, Porter’s Five Forces continue to serve as a significant tool in the arsenal of 21st century business strategists, proving its enduring value and relevance.

Competitive Rivalry

Competitive rivalry, one of the key elements of Porter’s Five Forces, examines the degree and nature of competition within an industry. An industry with intense competition is characterised by many players vying for the same customers and resources, which can lead to increased pressure on prices, margins, and profitability. Factors influencing the intensity of competition include the number of competitors, industry growth rate, product or service similarity, customer loyalty, and exit barriers. For example, in a slow-growing industry, companies can only grow by capturing market share from each other, leading to intense competitive rivalry. Understanding the dynamics of competitive rivalry can help businesses identify opportunities for differentiation, develop competitive strategies, and ultimately achieve sustainable competitive advantage.

Examples of Competitive Rivalry

Competitive rivalry manifests in various ways across different industries. Here are a few examples:

Fast Food Industry: In the fast food industry, businesses like McDonald’s, Burger King, KFC, and Subway compete constantly. These companies frequently launch new products, offer special deals, and invest heavily in advertising campaigns to attract customers.

Tech Industry: Apple and Samsung are prominent examples in the tech industry. They are continuously competing, releasing new smartphone models and technologies to outdo each other and capture the largest market share.

Airlines: Airlines also exhibit competitive rivalry. Carriers such as Delta, United, and American Airlines compete on factors like ticket prices, customer service, routes, and in-flight amenities.

Retail: In the retail sector, rivalry between companies like Walmart and Amazon can be seen. Both try to undercut each other on prices and delivery times while continuously expanding their product range.

Understanding these examples can help firms navigate competitive rivalry in their own industries by offering insights into successful strategies and potential pitfalls.

Threat of New Entrants

The threat of new entrants, another critical component of Porter’s Five Forces, refers to the ease with which new competitors can enter a particular market. High barriers to entry generally discourage new competitors, thus reducing the threat level. These barriers can take various forms, including high startup costs, strong brand loyalty, strict government regulations, access to distribution channels, and proprietary technology or patents.

Conversely, a market with low barriers to entry may face a high threat of new entrants, which can erode the profitability and market share of existing companies. For instance, the tech startup scene often experiences a high threat of new entrants due to low initial capital requirements. At the same time, heavily regulated industries such as utilities or telecommunications tend to have low threat levels.

Businesses must thoroughly assess this force to devise effective strategies that protect their market position and maintain competitive advantage.

Examples of Threat of New Entrants

The threat of new entrants varies across industries. Let’s explore some examples:

Social Media Platforms: The industry is dominated by giants like Facebook, Instagram, and Twitter. New entrants find it challenging to gain users due to the network effect—the value of a social media platform increases with the number of users it has.

Pharmaceuticals: This industry faces a low threat of new entrants due to high research and development costs, stringent regulatory requirements, and long lead time required to bring a new drug to market.

E-commerce: The rise of the internet has lowered barriers to entry in retail, increasing the threat of new entrants. However, strong brand loyalty and massive logistics operations of companies like Amazon can make it difficult for new players to gain significant market share.

Food Trucks: Lower startup costs compared to traditional restaurants make the food truck industry susceptible to new entrants. However, factors like location, food quality, and price still play a crucial role in determining success.

Understanding these examples can provide valuable lessons for companies assessing the threat of new entrants in their industry.

Bargaining Power of Suppliers

The bargaining power of suppliers is a significant force within Porter’s Five Forces model. It analyzes the degree of control that a company’s suppliers have over the pricing of goods and services. When only a few suppliers exist, they can dictate price terms, impacting a company’s profitability. Factors that enhance suppliers’ power include the uniqueness of the product or service, the number of suppliers available, the presence of substitute products, and the cost of switching to another supplier

For example, if a particular component necessary for manufacturing a product is only available from a single supplier, that supplier can dictate prices, asserting significant bargaining power. Businesses must understand this dynamic to negotiate effectively with suppliers and control costs.

Examples of Bargaining Power of Suppliers

The bargaining power of suppliers differs across industries. Here are some examples:

Aerospace Industry: In the aerospace industry, companies like Boeing and Airbus, face high supplier power. There are few suppliers for specific parts; switching suppliers can be costly and time-consuming.

Automobile Industry: In the automobile industry, many suppliers are available for standard parts, reducing their bargaining power. However, a few suppliers may hold significant power for specialised components or proprietary technology.

Healthcare: In the healthcare industry, pharmaceutical companies hold significant power. Medical institutions rely on them for critical drugs, and there aren’t many alternatives available.

Agriculture: In the agriculture industry, suppliers of seeds and fertilisers can have bargaining power, especially if these are specialised or patented products.

Grasping these examples can enable firms to better manage the bargaining power of suppliers in their own industries, helping maintain profitability and competitive advantage.

Bargaining Power of Buyers

The bargaining power of buyers is yet another crucial element of Porter’s Five Forces model. This force examines how buyers can influence the pricing and quality of goods or services. Buyers with strong bargaining power can demand lower prices or higher product quality, affecting a firm’s profitability. Factors that strengthen buyers’ power include many suppliers, low switching costs, and availability of substitute products. Conversely, strong brand loyalty, differentiated products, and high switching costs can limit buyers’ power. As such, understanding the bargaining power of buyers is key for businesses to strategise effectively and ensure sustainable profit margins.

Examples of Bargaining Power of Buyers

The bargaining power of buyers varies greatly depending on the industry. Here are some examples:

E-commerce: In the e-commerce industry, buyers have significant power due to the plethora of suppliers and ease of switching between platforms. However, factors like brand loyalty and unique product offerings can limit this power.

Telecommunications: In the telecommunications sector, the bargaining power of buyers is high due to low switching costs and numerous service providers. Nevertheless, contract terms and network coverage can limit this power.

Automobile Industry: In this industry, buyers have a reasonable amount of power due to the availability of numerous brands and models. However, brand loyalty and quality perceptions can curb this power.

Real Estate: In the real estate industry, the bargaining power of buyers can vary significantly. It can be high in a buyer’s market with many properties available but limited in a seller’s market where property availability is low.

By understanding these examples, companies can better predict and manage the bargaining power of buyers in their respective industries, thus optimising pricing strategies and maintaining competitiveness.

Threat of Substitution

The threat of substitution is another important aspect of Porter’s Five Forces model. This force is concerned with the likelihood of your customers finding a different way of doing what you do or switching to a different product or service that satisfies the same need. The existence of close substitute products can make an industry more competitive and decrease the profit potential for the existing firms.

High switching costs can deter customers from switching to substitutes, thereby reducing the threat of substitution. On the contrary, low switching costs and the availability of multiple alternatives amplify this threat. Therefore, it’s crucial for businesses to constantly innovate and enhance their product or service offerings to maintain a competitive edge and customer loyalty.

Examples of Threat of Substitution

The threat of substitution can vary significantly from industry to industry. Here are some examples:

Soft Drinks Industry: In the soft drinks industry, there’s a high threat of substitution from beverages such as tea, coffee, juices, and water. Health and wellness trends can also influence consumers to choose healthier alternatives.

Streaming Services: In the realm of streaming services, the threat of substitution is high due to the multitude of streaming platforms like Netflix, Amazon Prime, Hulu, and Disney+. The ease of switching and the low cost of alternate services intensifies this threat.

Pharmaceuticals: In the pharmaceutical industry, the threat of substitution is low due to the critical nature of many drugs and the lack of suitable alternatives. However, generic versions of prescriptions can represent a potential threat.

Public Transport: In the public transport sector, the threat of substitution can be high from alternatives like private vehicles, taxis, and ride-sharing services.

By understanding these examples, businesses can better anticipate and manage the threat of substitution in their respective industries, shaping their strategic decisions effectively.

Leveraging Porter’s Five Forces for Success

To navigate the 21st-century business landscape, companies should integrate Porter’s Five Forces into their strategic planning. Regularly analysing these forces can help businesses identify shifts in competitive dynamics, offering critical insights for decision-making.

Furthermore, businesses should leverage technology to enhance their competitive position. For instance, data analytics can provide valuable insights into customer behaviour, helping businesses better meet their needs and strengthen customer loyalty.

In conclusion, Porter’s Five Forces remains a timeless tool for understanding and navigating the complex dynamics of modern business environments. By regularly analysing these forces and adapting accordingly, businesses can gain a competitive edge, make informed decisions, and achieve long-term success in their respective markets.